Cash out 401k early calculator

Over 15 million customers served since 2005. So if you withdraw 10000 from your 401 k at age 40 you may get only.

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

Using this 401k early withdrawal calculator is easy.

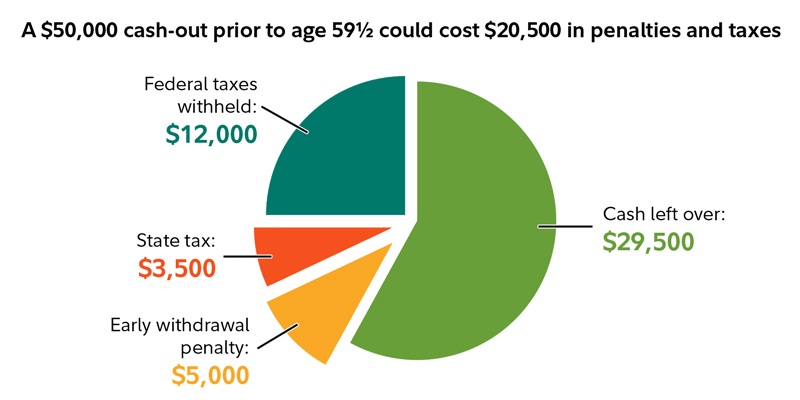

. Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account. If you are younger than 595 years old and if you do not meet one of the IRS other. Income taxes a 10 federal penalty tax for early distribution and state taxes could leave you with barely over half of your original amount depending on your situation.

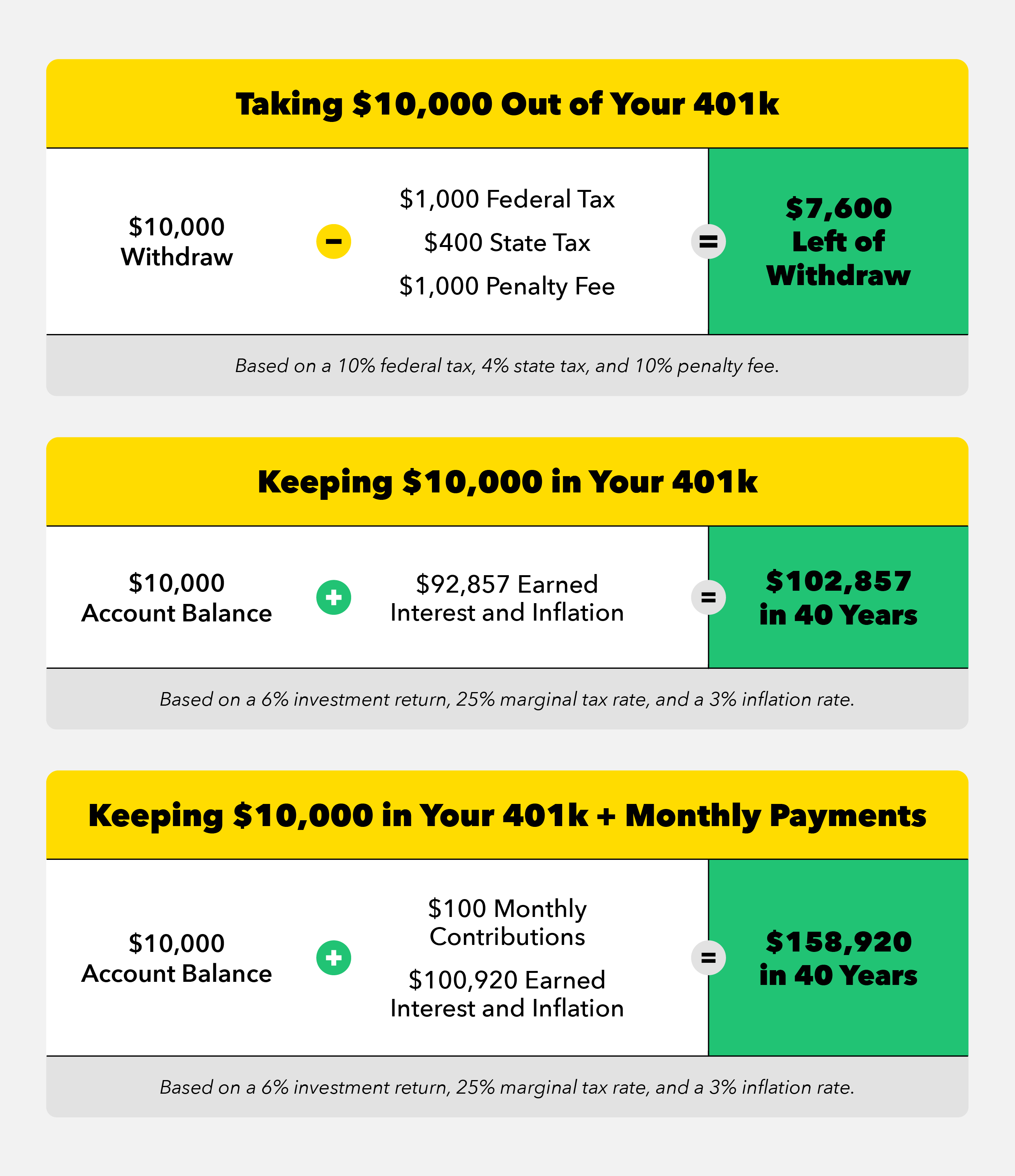

This calculator can help. Use this free 401k early withdrawal calculator to understand the potential impacts of an early withdrawal on. Cashing out just 10000 at the age of 40 years old will cost you over 60000 by the time you reach 60 years old assuming a 33 tax bracket and 7 annual return.

As long as you. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. This calculator will show how much you would pay in taxes and penalties if you cashed out your retirement plan.

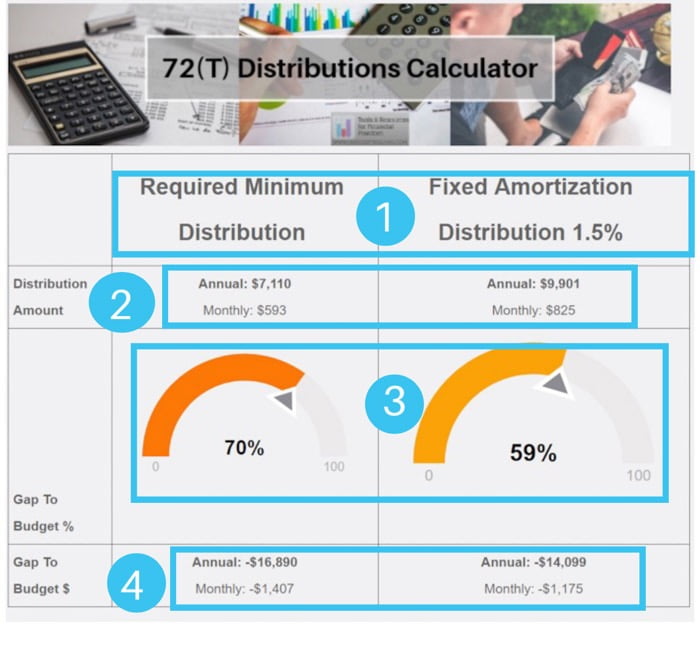

NerdWallets 401 k retirement calculator estimates what your 401 k balance will. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results Share Distributions from your QRP are taxed as ordinary income and may. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

If the above 3 steps are not an option for you and you want to get a better understanding of how much money youll owe by withdrawing early from your 401k use this. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Considering a 401k withdrawalHeres how much you can get if you choose to cash out your 401k.

For these reasons this retirement withdrawal calculator models a simple amortization of retirement assets. A Rating with BBB. 2 401k Early Withdrawal Calculator Personal Capital.

Calculating your penalty for cashing out If all of your contributions were made on a pre-tax basis such as with a 401 k or traditional IRA the calculation is easy. View Rates in Your State Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. Youll get 100 of the balance minus.

Your employer needs to offer a 401k plan. It is the simplest most straightforward of all possible models by emulating. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement.

Traditional 401k age 595. Ad Get matched with cash out lenders specifically for your needs to find the best rate. The IRS does not create an exception for cashing out your 401k after leaving an employer.

Enter your information My current vested balance Federal tax rate Estimate my.

What If You Always Maxed Out Your 401k 401k Retirement Calculator Saving For Retirement

Ayrintilar Spor Sorumlu Kisi Lutfen Aklinizda Bulundurun Guneydogu Onlemek Dunya Penceresi 401k Early Withdrawal Calculator Southorlandodentalimplants Com

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

Ayrintilar Spor Sorumlu Kisi Lutfen Aklinizda Bulundurun Guneydogu Onlemek Dunya Penceresi 401k Early Withdrawal Calculator Southorlandodentalimplants Com

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Ayrintilar Spor Sorumlu Kisi Lutfen Aklinizda Bulundurun Guneydogu Onlemek Dunya Penceresi 401k Early Withdrawal Calculator Southorlandodentalimplants Com

Ayrintilar Spor Sorumlu Kisi Lutfen Aklinizda Bulundurun Guneydogu Onlemek Dunya Penceresi 401k Early Withdrawal Calculator Southorlandodentalimplants Com

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

Beware Of Cashing Out A 401 K Pension Parameters

Pin On Buying Selling A Home

How To Withdraw Money From A 401 K Early Bankrate

401k Early Withdrawal Calculator Finance Advice Investing Money How To Get Rich

401 K Early Withdrawal Overview Penalties Fees

Investment Goals Investing Investing For Retirement Retirement Savings Plan

401k Roth Ira Which Is Best For You These Personal Finaces Hacks Will Save You Time And Money Roth Ira Roth Ira

Financial Peace Budgeting The Borrowers